Specialized Level III Merchant Services for Government and Corporate Clients

Government Contractor Processing

Complete Level III credit card processing for Maryland government contractors with GSA SmartPay compliance, detailed line-item reporting, and competitive interchange rates. Our government merchant services include specialized reporting for federal, state, and local contracts.

Corporate Purchasing Card Processing

Streamlined Level III processing for corporate purchasing departments with detailed expense tracking, employee spending controls, and comprehensive reporting. Our B2B merchant services integrate with accounting systems and procurement software.

Large Ticket Transaction Processing

Specialized Level III credit card processing for high-value transactions with optimized interchange rates and enhanced security features for large corporate purchases and government contracts.

Multi-Location B2B Processing

Centralized Level III merchant services for corporations with multiple locations, unified reporting, consolidated billing, and consistent government compliance across all sites.

Specialized Level III Processing for Government and Corporate Sectors

Federal Government Contractors

- GSA Schedule contract compliance with Level III merchant services

- Federal procurement regulation adherence and reporting

- SmartPay card processing with detailed line-item capture

- Audit trail documentation and compliance reporting

- Security clearance facility payment processing

- DCAA compliance and cost accounting integration

State and Local Government Processing

- State procurement compliance with Level III credit card processing

- Municipal purchasing card programs and controls

- Educational institution payment processing and reporting

- Healthcare system purchasing and expense management

- Public utility payment processing with detailed reporting

- Emergency services and public safety procurement processing

Corporate B2B Payment Processing

- Enterprise purchasing card programs with Level III merchant services

- Multi-location corporate payment processing and reporting

- Vendor payment automation and procurement integration

- Employee expense management and control systems

- Corporate travel and entertainment processing

- Supply chain payment optimization with detailed tracking

Large Ticket Transaction Specialists

- Visa large ticket transactions over $8,000 qualify for additional Level III interchange reductions with rates of 1.45% + $35 for commercial products

- MasterCard large ticket thresholds vary by card type and program (contact us for current requirements)

- Equipment financing and leasing payment processing

- Construction and manufacturing payment solutions

- Professional services and consulting payment processing

- Technology and software purchase processing

- Capital equipment and machinery payment solutions

Level III Interchange Rate Savings and Cost Optimization

Visa Level III Interchange RatesSignificant savings with Level III data submission compared to Level I processing. Large ticket transactions over $8,000 qualify for commercial large ticket rates of 1.45% + $35 when properly qualified with complete Level III data capture.

MasterCard Level III Interchange RatesOptimized MasterCard Level III processing rates for corporate cards including Enhanced, World Business, and World Elite Business categories. Large ticket processing thresholds vary by card program - contact us for current qualification requirements.

Government SmartPay OptimizationSpecialized GSA SmartPay processing with Level III data capture provides the lowest possible interchange rates for government contractors while ensuring compliance with federal procurement requirements.

Cost Comparison AnalysisLevel III processing can save businesses up to 1.5% per transaction compared to Level I processing rates. Most government contractors and B2B businesses achieve significant monthly savings with proper Level III merchant services implementation.

Automatic Rate QualificationOur specialized Level III credit card processing systems through Accept.Blue, USAePay, NMI, and Valor PayTech automatically capture required data fields to ensure qualification for lowest interchange rates without additional staff training or complex procedures

Monthly Savings ReportingComprehensive reporting showing actual interchange savings achieved through Level III processing compared to standard rates, helping justify merchant services costs and demonstrate ROI.

Advanced Level III Credit Card Processing Technology and Integration

Specialized Level III Processing Platforms

Professional Level III credit card processing through our certified technology partners including Accept.Blue, USAePay, NMI, and Valor PayTech - all designed specifically for Level III data capture with automatic prompts for line-item details, tax amounts, freight charges, and government compliance fields.

Accept.Blue Level III Gateway

Advanced Level III processing platform with automatic data capture, government compliance features, and optimized interchange rate qualification for corporate and government transactions.

USAePay Level III Solutions

Comprehensive Level III credit card processing with detailed reporting, corporate purchasing integration, and automated compliance documentation for government contractors.

NMI Level III Processing

Robust Level III merchant services platform with advanced data capture, interchange optimization, and seamless integration with accounting and procurement systems.

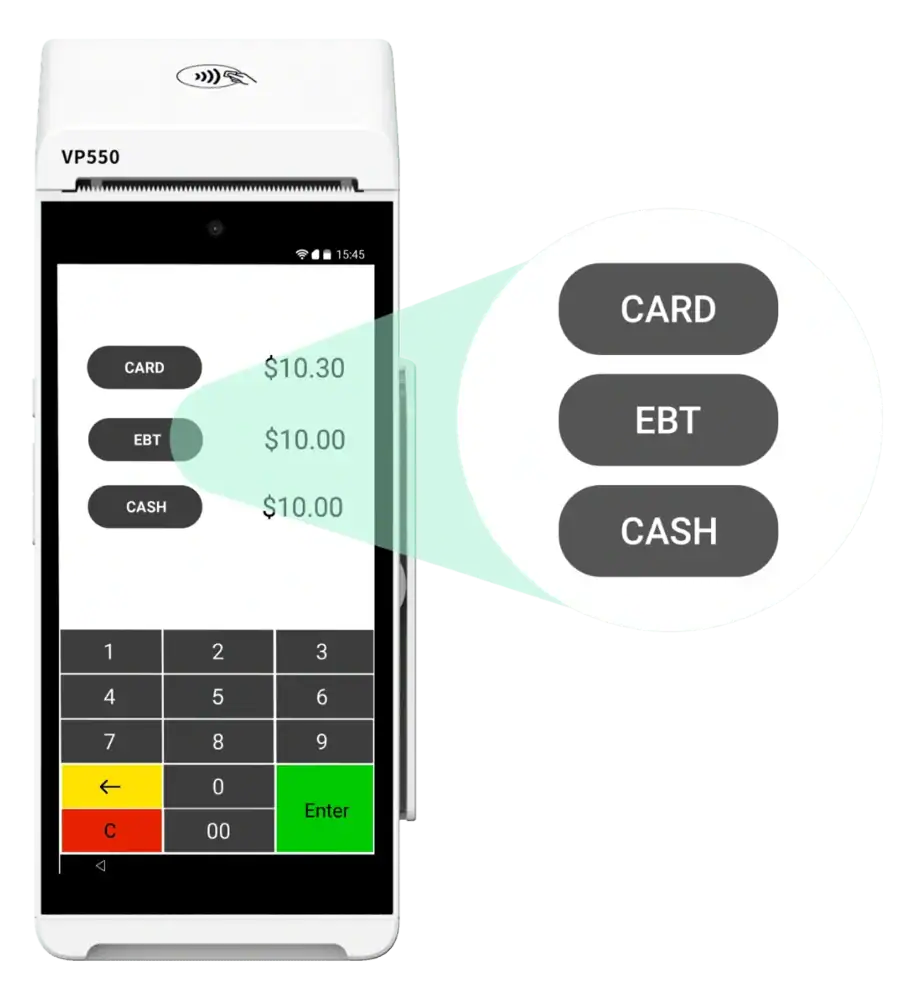

Valor PayTech Level III Equipment

Professional payment terminals and equipment designed specifically for Level III data capture with government compliance features and corporate purchasing optimization.

Accounting System Integration

Direct integration with QuickBooks, SAP, Oracle, and other accounting systems for automatic Level III data population and seamless reconciliation of government and corporate transactions through all our processing platforms.

Procurement Software Connectivity

Integration with procurement platforms, purchase order systems, and vendor management software for automated Level III data capture and processing workflow optimization across all technology partners.

Mobile Level III Processing

Portable Level III credit card processing solutions for field operations, construction sites, and remote government facilities with full data capture capabilities through our mobile-enabled platforms.

API and Custom Integration

Custom API integration for specialized government and corporate systems requiring unique Level III processing workflows and compliance reporting requirements across all our technology partners.

Why Maryland Government Contractors Choose Elite Card Processing

Local Government Processing Specialist

Our Maryland-based Level III merchant services team provides professional installation, staff training, and ongoing compliance support. When you need help with government processing, you get same-day service from local technicians who understand federal procurement requirements.

Government Compliance Expertise

Deep understanding of GSA regulations, federal procurement requirements, and state/local government purchasing policies. We've provided Level III processing for thousands of Maryland government contractors and B2B businesses.

Same-Day Government Support

Level III processing problems during critical procurement periods? Our local government merchant services team provides same-day support and equipment replacement throughout Maryland, Pennsylvania, and West Virginia.

Security Clearance Facility Experience

Experience providing Level III credit card processing for security clearance facilities, defense contractors, and sensitive government operations with appropriate security protocols and compliance measures.

Audit Support and Documentation

Complete audit trail documentation, compliance reporting, and support during government audits and procurement reviews with detailed Level III transaction records and reporting.

Government Growth Partnership

We grow with your government contracting business, providing Level III processing upgrades, additional location support, and enhanced compliance features as your contracts expand.

Maryland Government Contractors and B2B Businesses Thriving with Level III Processing

Frederick County Defense Contractor

"Our Level III credit card processing with Elite Card Processing transformed our GSA compliance. The automatic data capture eliminated manual entry, audit documentation is comprehensive, and we're saving $3,200 monthly on interchange fees."

- GSA SmartPay compliance achieved automatically

- Interchange savings of $3,200 monthly

- Audit documentation streamlined and comprehensive

- Staff training minimal with automated data capture

Hagerstown Manufacturing Company

"The Level III processing system handles our corporate purchasing perfectly. Large ticket transactions qualify for better rates, procurement integration eliminated double entry, and reporting satisfies our accounting requirements."

- Large ticket interchange savings on equipment purchases

- Procurement system integration eliminated data entry

- Accounting reconciliation automated and accurate

- Corporate purchasing controls implemented successfully

Washington County Government Contractor

"Elite Card Processing's Level III merchant services helped us win more government contracts. Agencies prefer vendors who can provide detailed transaction data, and our compliance documentation is always audit-ready."

- Government contract competitiveness improved

- Detailed transaction reporting for all agencies

- Audit-ready compliance documentation maintained

- Processing costs reduced with Level III rates

Multi-State Corporate Client

"Managing Level III processing across multiple states was complicated until Elite Card Processing centralized our merchant services. Now we have unified reporting, consistent compliance, and significant cost savings."

- Centralized multi-state Level III processing

- Unified reporting across all corporate locations

- Consistent compliance and documentation standards

- Significant cost savings with optimized interchange rates

Government Compliance and Level III Processing Requirements

GSA SmartPay Compliance

Complete GSA SmartPay card processing compliance with Level III data capture, detailed reporting, and audit trail documentation required for government contractors and federal agencies.

Federal Procurement Regulations

Full compliance with federal procurement regulations including FAR requirements, DCAA cost accounting standards, and security protocols for government contractor merchant services.

PoST Pilot Program Requirements

Compliance with the PoST Pilot Program for 51V Schedule Contracts requiring Level III data on all GSA SmartPay transactions, giving participating vendors competitive advantages in government contracting.

Government Charge Card Controls

Implementation of controls and safeguards required by the Government Charge Card Abuse Prevention Act with Level III line-item detail providing ready-made solutions for new requirements.

State and Local Compliance

Compliance with state and local government procurement requirements, municipal purchasing policies, and educational institution payment processing regulations.

Audit Trail and Documentation

Comprehensive audit trail documentation, transaction reporting, and compliance records required for government audits, procurement reviews, and contract compliance verification.

Get Your Maryland Business Level III Credit Card Processing Today

Free Level III Consultation Includes:

- Government contractor needs assessment and compliance review

- Current processing cost analysis and Level III savings calculation

- Interchange rate optimization and cost-benefit analysis

- Compliance requirement evaluation and implementation planning

- Technology integration planning and staff training timeline

- Ongoing support and Level III merchant services implementation plan

Why Choose Elite Card Processing for Level III Merchant Services:

- Local Maryland Level III processing company with government expertise

- Professional equipment installation and comprehensive compliance training

- Competitive Level III interchange rates with transparent pricing

- GSA SmartPay compliance and government contractor specialization

- Integration with accounting and procurement systems included

- Scalable Level III processing solutions for growing government contractors

Contact Elite Card Processing - Your Maryland Level III Specialist

Local (Hagerstown)

Toll-Free:

Email:

Visit:

13701 Maugansville Rd #5, Hagerstown, MD 21740

Payment Processing Service Areas (Primary)

All of Maryland, Pennsylvania, and West Virginia

Payment Processing Service Areas (National)

We can help any retail business within the United States

Next Steps for Level III Merchant Services:

1.Contact us for free Level III consultation

2.Compliance assessment and technology demonstration

3.Professional installation and staff training

4.Ongoing support and Level III processing optimization

Level III Processing Resources and Government Support

Government Business Growth:

- Merchant cash advance for government contractor financing

- Account management portal for Level III transaction monitoring

- Government compliance consulting and audit support

- Procurement system integration and optimization

Level III Support and Training:

- Professional Level III equipment installation and setup

- Comprehensive government compliance training programs

- Ongoing technical support for Level III credit card processing

- System updates and government regulation compliance

- 24/7 Level III merchant services support

COMPLIANCE NOTICE

Level III Processing Compliance Notice:Level III processing requirements and interchange thresholds are subject to change by Visa, MasterCard, and other card networks. Information last verified: July 28, 2025, based on current industry standards and verified sources including Revolution Payments industry data. Contact Elite Card Processing for current qualification requirements, specific thresholds, and the most up-to-date interchange rates for your business type.

Are you ready to take your business to the next level?

Are you in ready to grow your business and take that next step in your business plan, but need some capital to get it moving? Elite Card Processing has an opportunity for you to get the financing you need, today! Our solution doesn’t have a complicated approval process or long waiting periods. And even better, you can request same day funding! You can use these funds to invest in a better technology system, increasing inventory, or payroll. Our program has a variety of repayment options available to ensure you can reach your goals, and not get into a debt trap. If you’re ready to apply go ahead and click to Get Started!

Contact Us Today For A Free Quote!